Hsa Increase 2025

BlogHsa Increase 2025. The annual maximum hsa contribution for 2025 is: Changes are effective on the employers' effective or renewal date beginning jan.

The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025. Hsa contribution limit for self coverage:

With effect from 1 july 2025, a fee increase averaging 5% will be implemented, with a minimum increase of $1 and capped at $200 per fee item.

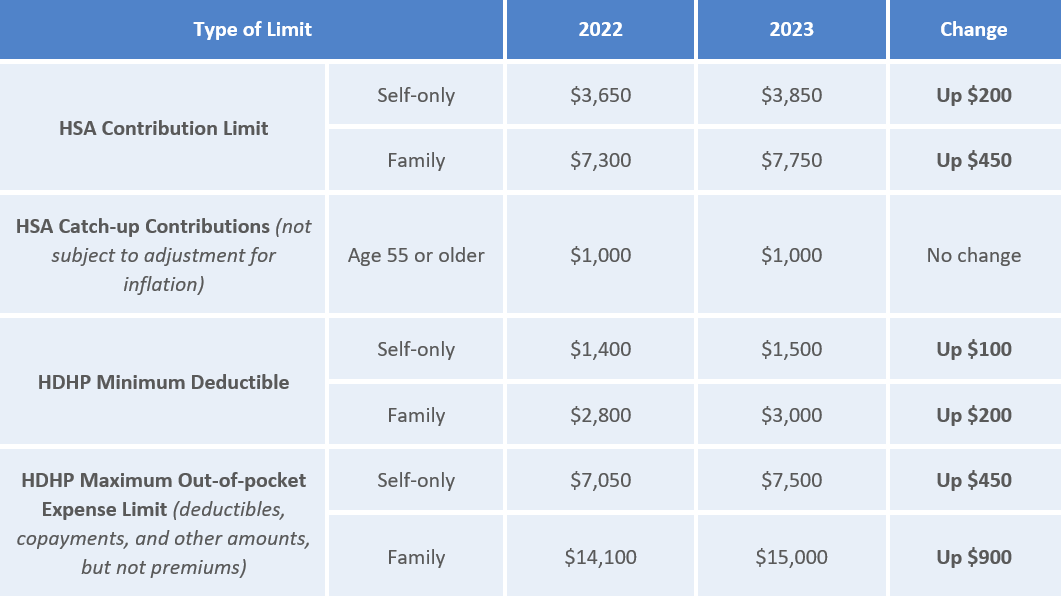

Annual health savings account contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

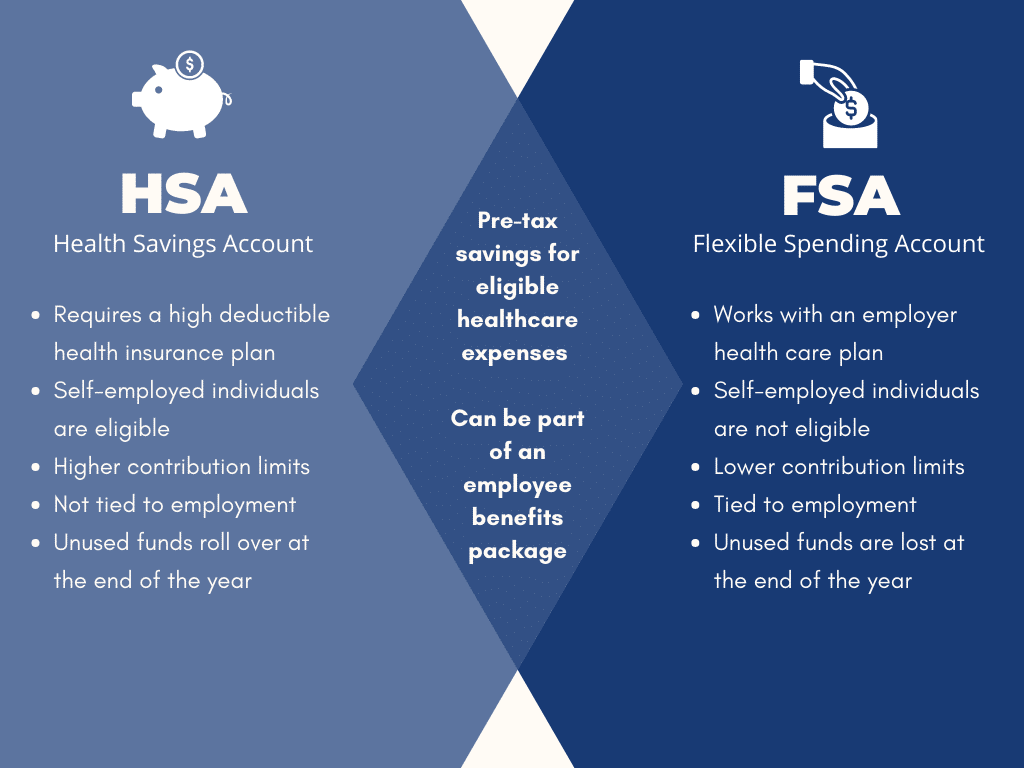

What is an HSA? Health Insurance Explained Therapy Today, The annual maximum hsa contribution for 2025 is: With inflation still at high levels, we will have a second consecutive year of unusually large increases to the hsa contribution limits.

Health Savings Account (HSA) Limits Increase for 2025 HRWatchdog, With effect from 1 july 2025, a fee increase averaging 5% will be implemented, with a minimum increase of $1 and capped at $200 per fee item. The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation.

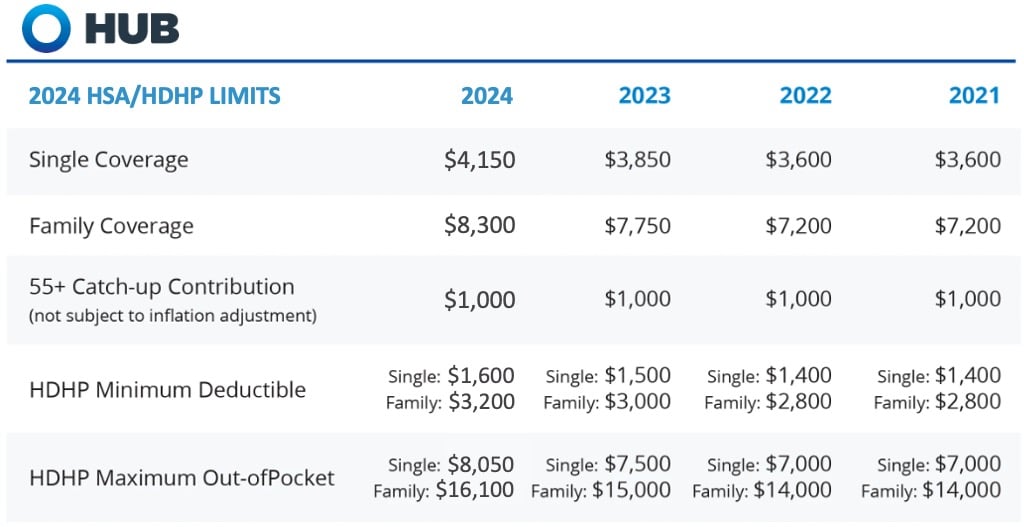

HSA/HDHP Limits Will Increase for 2025, The annual maximum hsa contribution for 2025 is: The irs announced that 2025 hsa contribution limits will increase to $4,150 for.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Irs raises hsa limit for 2025 with record increase. The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025.

HSA and HDHP Limits Increase for 2025, Those 55 and older can. The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation.

HSA/HDHP Contribution Limits Increase for 2025, Increases to $4,150 in 2025, up $300 from 2025; Announcing 2025 irs hdhp and hsa limits.

The Top 10 Benefits of Having an FSA or HSA, Changes are effective on the employers' effective or renewal date beginning jan. Increases to $4,150 in 2025, up $300 from 2025;

contribution limit costsharing limits HDHP HDHP Limit HSA HSA, Annual health savings account contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds.

HSA/HDHP Limits Will Increase for 2025, The annual maximum hsa contribution for 2025 is: Increases to $4,150 in 2025, up $300 from 2025;

2025 HSA & HDHP Limits, Announcing 2025 irs hdhp and hsa limits. Hsa contribution limit for self coverage: